Online Banking Fraud and Security Centre

- Criminals are targeting customers by sending text messages or calling you pretending to be AIB.

- Be careful and never click a link in a text message.

- Never share your card reader codes or one-time passcodes.

Important Update: For information on changes to how you log in to your Phone and Internet Banking, click here.

Current Fraud and Security Alerts

Latest Update: April 2024

Call Scam Alert

Call Scam Alert

Investment Scam Warning – Criminals are using genuine AIB staff names in the latest scam

AIB urges people to exercise caution as a number of investment scams are in circulation. Most of these scams bear similar hallmarks with minor variations. In the current scams criminals are using a fake AIB email address with a real AIB staff name e.g. johndoe@aibirish.ie rather than johndoe@aib.ie. A person is contacted by a bad actor after filling out a contact form on a fake website purporting to offer investment products from legitimate, well-known names in financial services. The scammers often share sophisticated brochures and materials that appear legitimate. After the person fills out all the relevant ‘documents’, they are asked to transfer their money to an account which they later realise does not belong to the financial services firm and their money has been stolen. This often happens under a degree of time pressure, for example “to get the best rate of return”. Some of these scams also attempt to defraud customers seeking to invest in crypto currencies.

AIB urges people to:

- Ensure you verify the contact details by checking the official company’s website.

- Do not call the number provided on the email. Search and confirm the phone number using the bank’s website.

- You can also cross reference email addresses to ensure they are aligned with the format of the firms existing email addresses as shown on their website.

- Ensure any website you use is secure and genuine by checking for the padlock symbol to the left of the web address and if it’s not there, beware.

- Check the advisor out, look them up to see if their business exists by ensuring their office location and telephone number are genuine.

- Call your bank before you make the payment and ask them to check the transaction and beneficiary account. This one call could save your money from being stolen by fraudsters.

- Check the Central Bank of Ireland’s consumer hub and its list of unauthorised firms for guidance on how to protect yourself from financial scams. Simply enter ‘search for unauthorised firms’ on centralbank.ie.

- Always seek investment advice from a regulated financial advisor even when recommendations are made by people you trust, such as family or friends.

Remote Access Warning

Criminals are calling people pretending to be from the bank advising that there is a problem with your account or a fraud payment. The purpose is to trick you into allowing them to install remote access software (e.g., Any Desk) on your computer. They then try to make payments themselves and convince you to authorise them by providing codes from your Card Reader. Don’t Engage. Hang up. Warn your staff if you are a business.

- A call is received from a person purporting to be from your bank or a service provider like a utility company.

- They try to convince you they are genuine - sending texts confirming they are from the bank and ask questions like, what kind of devices you use for online banking? or Tell you there is a payment leaving your account or that there is an Issue with your Internet Router.

- They try to get you to let them download software to fix the problem.

- The software enables them to login to your account remotely:

- The name of one of the ones that they use is AnyDesk via AIB [or some version of the bank name].com

- They log into your online banking.

- They can see your transactions and use the information to convince you they are genuine.

- Their aim is to steal your money.

Never give codes from your Card Reader or Digipass to someone who calls you.

Text Scam Alert

Text Scam Alert

Fraudsters are targeting customers like you by sending text messages claiming to be AIB and/or other legitimate companies. These messages request you to click a link to review or block a fraudulent transaction on your account, or advise that you are locked out of your account. You may also be asked to input codes from your Card Reader or divulge a One Time Passcode (OTP).

These text messages are fraudulent.

- NEVER disclose your Registration Number or Personal Access Code (PAC) or card information after clicking a link in a text.

- NEVER generate codes from your AIB Card Reader when they are requested by a text message or on receipt of an unexpected call.

- NEVER divulge your One Time Passcode (OTP) for Card transactions.

- NEVER move your funds to a safe account.

- REMEMBER we are not making house calls to collect your cards

If you have received such a call or text message and have disclosed any information, please contact us immediately.

For additional hints and tips on how to Be Informed, Be Alert and Be Secure, visit FraudSMART.ie

Below are some examples of fraudulent texts messages:

Text Followed by a Call

Text Followed by a Call

Customers who have clicked on fraud texts are getting follow up calls from the criminals looking for more information and codes from their Card Reader ( to authorise payments)

These phone calls are Fraudulent.

- NEVER download any software/apps allowing the caller access to your PC or mobile phone.

- NEVER disclose your Registration Number or Personal Access Code (PAC) to the caller.

- NEVER generate or provide codes from your AIB Card Reader to the caller.

- NEVER divulge your One Time Passcode (OTP) for Card transactions.

- NEVER give your debit card to a taxi driver who innocently delivers it to the criminals

Text Scam Alert

Text Scam Alert

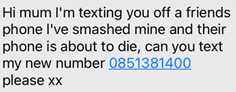

The Mum and Dad Scam

In this scam criminals contact you (usually on WhatsApp) from an unknown number, pretending to be your child or grandchild who needs help.

The messages might look like this:

The message will go on to ask for money for something dramatic and urgent.

This is usually a scam where criminals are trying to get you to transfer money to them.

See Common Frauds and Threats for more details.

Investment Fraud

Investment Fraud is one way criminals can steal your money. They try to convince you to invest in a scheme, shares or commodities, which either don’t exist, or aren’t worth the money paid for them. These scams are common and are usually perpetrated through aggressive sales tactics. They’re well organised and very convincing. Scammers will target anyone who responds to them and build trusting relationships with their victims over a period of time. Unfortunately, many of these scams are successful. There are many types of scams fraudsters use to persuade you to part with your money.