You don’t have to own the car to boss the drive.

It’s all about the experience.

You may not own the music when you listen to it, you don’t own the movie when you watch it, now you don’t have to own the car to drive it.

Personal Contract Hire also known as Personal Leasing is a way to drive a new car, without having to pay to own it. It’s more cost effective, easier, and greener than owning a car.

-

More cost effective because you’re not paying for the full cost of the car.

-

Easier because you just hand the car back with no balloon payment at the end of the term.

-

And greener because it’s easier to drive the latest technology that electric vehicles have to offer.

How does it work?

-

Drive a new car for a fixed period and pay each month to use it for that time

-

No need to worry about the value of the car dropping, just return it at the end of the contract. Fixed price servicing and maintenance options are available.

Who does it suit?

If owning the car is not that important to you and you're happy to hand it back at the end of term, then Personal Contract Hire could be a good option for you.

Nifti

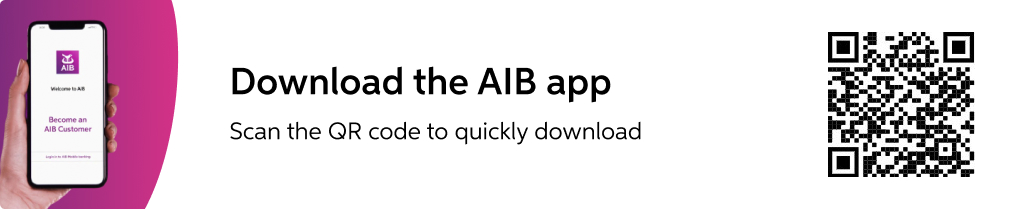

AIB offers Personal Contract Hire in partnership with Nifti.

Nifti offers lots of car brands to personal customers under leasing arrangements. That means you can lease a car for a fixed monthly payment with no balloon or residual payments at the end of the term. To find out more or to apply please visit the Nifti website.